The cost of capital is an indication of the cost a business incurs to finance itself, and it’s an important metric for a business. As the cost of capital fluctuates, which it will, the cost of doing business will change. It’s also an important benchmark for managers who recommend investments for their businesses. A manager must demonstrate that an investment will generate returns equal to or greater than its business’s cost of capital.

In today’s business environment of rising interest rates, the cost of capital is increasing, and leaders must keep it top of mind as they consider new investments and assume additional operating expenses.

What Is Cost of Capital?

A business uses capital, or cash, to fund its day-to-day operations as well as make investments to promote growth. There are two primary sources of capital for a company: liabilities and equity.

Liabilities represent capital that lenders provide debtors. Liabilities are bound by a contractual commitment between a lender and a debtor and bear a cost of interest. The contractual commitment guarantees that the debtor will pay the lender. One of the most common types of liabilities is bank debt. The interest rate a business pays its bankers for outstanding debt would be considered its cost of interest. Other types of liabilities are payments owed to vendors and suppliers, wages owed to employees, or taxes owed to the government. (To learn more about liabilities, click here.)

Equity is capital provided to a company by investors. A common event that raises capital for a publicly held company is an initial public offering (IPO). Unlike liabilities, cash provided by investors is not bound by a contractual agreement. Therefore, there’s no guarantee investors will generate a return on their investment or even recover their initial investment. Equity does not bear a cost of interest, but it does carry an expectation cost or cost of equity. This means that investors have an expectation about a rate of return on their investments. (To learn more about equity and expectation costs, click here.)

The cost of capital for a business represents the combined cost of interest and cost of equity for the capital funded by liabilities and equity, respectively. The combined rate of the cost of interest and cost of equity incurred by a company is known as weighted average cost of capital, or WACC. (To learn more about weighted average cost of capital, click here.)

Why Is Cost of Capital Important?

As either the cost of interest or cost of equity rises, the cost of capital for a business will increase. This means that the cost of the cash a company receives to support itself and grow becomes more expensive. For example, if interest rates increase, the cost of interest increases for a company. And as interest rates increase, the expectation cost of equity will increase.

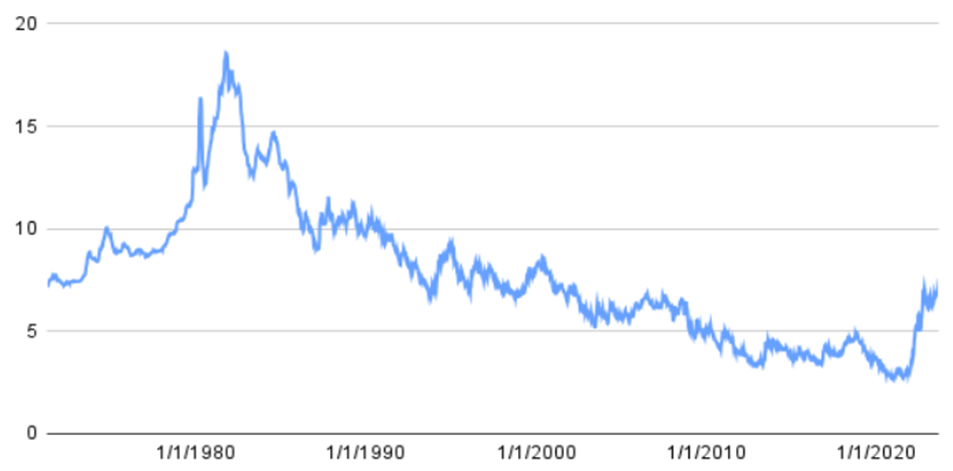

Over the past decade, the cost of capital has been historically low. This means that borrowing money is less expensive and can lead to higher profitability for companies. However, since the pandemic, interest rates in the United States have risen dramatically. Interest rates are controlled by the Federal Reserve, which has been raising interest rates since then to combat inflation.

Historical Interest Rates – 1970-2023

Rising interest rates and cost of capital can be problematic for a company that use extensive debt (liabilities) to fund its business. As interest rates rise, its interest payments to lenders may increase, which will increase expenses and impact profitability. In extreme cases, a business may have difficulty making payments and could default on its loans.

As companies consider making investments in their business, they need to assess them relative to their cost of capital. An investment should match or exceed a company’s WACC; otherwise, it will negatively impact shareholder value. And as either the cost of interest or cost of equity rises, a company’s WACC will increase. When this occurs, it makes investments more expensive and harder to justify.

Cost of capital and weighted average cost of capital are important business concepts for managers and leaders to understand. They need to know that capital is not free and will fluctuate with the economy. And they need to understand the cost of capital in relationship to any investment they propose or implement.

A business simulation allows leaders to experience changes in the cost of capital. It provides a risk-free opportunity for them to react to fluctuations and see the consequences of their operating and investment decisions without the kinds of consequences they would experience in real life. To learn more about our leadership development offerings in Improving Business Acumen, head to this page of our site.

* * *

Liabilities

Liabilities are a contractual commitment between a lender and debtor. A lender is an entity providing capital or cash to another party. A debtor is a company or individual who borrows money from a lender. A debtor is often referred to as a borrower.

A bank loan is an example of a liability. It is bound by a contractual agreement — a bank note — where the debtor is required to pay the lender interest and principal payments over a specific period of time, which is referred to as a term. The note protects the lender and ensures the borrower pays interest and principal owed to the lender as defined in the bank agreement between them.

Cost of Interest

Liabilities bear a cost of interest. Interest refers to the rate the debtor pays the lender for money borrowed. The cost of capital of the bank loan described above would be equal to the cost of interest — for example, 5% per year.

Types of Liabilities

There are many types of liabilities. Some of the more common ones are:

-

Short- and long-term debt. This bears a cost of interest.

-

Corporate bonds. This bears a cost of interest.

-

Accounts payable: money owed to vendors and suppliers. This typically does not bear a cost of interest.

-

Accrued wages, salaries, and benefits: money owed to employees. This typically does not bear a cost of interest.

-

Taxes payable: money owed to the government for taxes. This typically does not bear a cost of interest.

Equity

Equity is capital or cash provided to a company by investors. Unlike liabilities, cash provided by investors is not bound by a contractual commitment. Therefore, there’s no guarantee an investor will receive a return on their investment or recover their initial investment.

Cost of Equity — An Expectation Cost

Cash provided by investors carries an “expectation” cost, or cost of equity. Even though there’s no guarantee investors will make money on or recover their initial investments, they do have expectations about a rate of return. For example, if you purchase shares of stock in a publicly traded company, you have an expectation that the stock will rise in value — that is, appreciate — and possibly receive a cash dividend.

Equity holders, or investors, expect a higher rate of return on their investment than the cost of interest, because equity money is not guaranteed by a contract and is, therefore, much riskier.

Investors and a company’s board of directors take this expectation cost seriously. If a company is unable to generate an acceptable rate of return to equity holders, their shareholders may sell their shares. This, in turn, can depress a company’s stock price.

The rate of return an investor expects depends on many variables, including prevailing interest rates, the history of a company’s performance, and other investment alternatives, such as real estate, commodities, or other company stock.

Calculating the Cost of Capital / Weighted Average Cost of Capital

An example can clarify the cost of capital and how it’s calculated. In the example below, Company ABC has liabilities and equity — or total capital — of $5,000,000, which it receives from different sources.

| Source of Capital | Amount | Rate | Annual Cost of Capital |

| Short Term Bank Loan | $250,000 | 6% | $15,000 |

| Accounts Payable | $500,000 | 0% | $0 |

| Taxes Payable | $500,000 | 0% | $0 |

| Long Term Debt | $1,000,000 | 5% | $50,000 |

| Corporate Bonds | $1,000,000 | 5% | $50,000 |

| Shareholder's Equity | $1,750,000 | 12% | $210,000 |

| Total Capital and Cost of Capital | $5,000,000 | $325,000 |

Company ABC receives capital in different amounts from a variety of sources, as seen above in the "Source of Capital" and "Amount" columns. For accounts payable and taxes payable, the rate used is 0%. This represents a total of $500,000 owed to vendors and the government. This capital is considered a free loan to Company ABC and bears no cost of interest. In essence, Company ABC is using its vendor’s and the government’s money to partially fund its operations.

Shareholder’s equity represents cash provided to Company ABC by investors. This capital carries a higher cost, or cost of equity, because shareholders have a higher expectation for a rate of return on their investment due to the risk associated with it.

The annual cost of capital for each source of capital is calculated by multiplying the amount of capital (second column above) by the rate indicated (third column). The rate is the cost of borrowing money for Company ABC. The total cost of capital for Company ABC is $325,000. Of this amount, Company ABC is contractually required to pay $115,000 each year to its liability holders, bankers, and bond holders. The $210,000 of shareholder’s equity cost of capital is realized by investors through stock appreciation and dividend payments. The $210,000 is the shareholder’s expectation for an annual rate of return, which Company ABC will work hard to deliver.

A company’s weighted average cost of capital (WACC) reflects the average rate, including both cost of interest and cost of equity, that a company pays on its total capital. This can by calculated for Company ABC by dividing its annual cost of capital ($325,000) by its total capital ($5,000,000). In the example provided, Company ABC’s WACC = $325,000/$5,000,000, or 6.5%.

Weighted average cost of capital is an important number for a business. If it’s unable to generate greater than 6.5% in annual returns, it is not using its liabilities and equity productively and will destroy shareholder value.

The additional example below demonstrates how WACC is calculated. This example will consider a hypothetical individual named John Doe and the different types of liabilities, or debt, that John personally has in order to calculate his personal WACC.

| Source of Capital | Amount | Rate | Annual Cost of Capital |

| Home Mortgage | $250,000 | 5% | $12,500 |

| Student Loan | $50,000 | 7% | $3,500 |

| Automobile Loan #1 | $20,000 | 8% | $1,600 |

| Automobile Loan #2 | $30,000 | 6% | $1,800 |

| Credit Card Debt | $10,000 | 18% | $1,800 |

| Total Capital (Debt) | $360,000 | $21,200 |

John’s WACC = $21,200 (Annual Cost of Capital) / $360,000 (Total Capital) = 5.9%

Ned Wasniewski

Ned Wasniewski is a managing partner at Insight Experience and has led multiple functions, including program facilitation, program management, delivery operations, account management, and business development. Ned has more than 20 years of experience in the management education business with a singular focus on the development and delivery of simulation-based learning experiences.